Is a recession on the horizon? Nobody knows for certain but from what I’ve been reading and listening to, there is agreement that, at best, the stock market is due for a correction and at worst we could see a recession.

It’s understandable that the idea of another recession strikes fear in people because of what happened in 2008, however the 2008 recession was historic and the likelihood of our economy experiencing a recession of that magnitude is very slim.

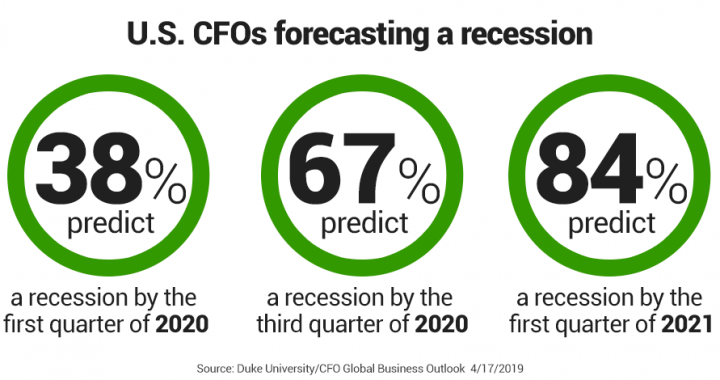

One article I read has the headline “Why There’s a 75% Chance of a Recession” and states “A recent report by the Duke Fuqua School of Business indicated that in a survey of CFOs, 67% believe the U.S. economy will enter a recession by the latter half of 2020; as much as 84% of respondents think the economy will be in recession by the first quarter of 2021.” If we accept that they are correct, we’ll see a recession in the next 12-24 months. So, what do you do to prepare your business?

- Start Preparing Now. One of the biggest mistakes you can make for your business is wait until a recession kicks in. Once a recession starts, your options will be limited and your business’s ability to navigate and survive will be much more difficult. Start preparing now.

- Have Cash Available. What we have learned from previous recessions is that during recessionary periods, cash becomes scarce and your business needs to be ready to face that reality. You can be sure you have cash available by simply putting money in a savings account each week or each month. For example, set a requirement that 10% on your weekly deposits need to go into a separate savings account. Another source of cash is lines of credit or equity lines, but those need to be established now. If you already have those in place, are the amounts sufficient or could you ask for an increase? Don’t wait for the economy to slow, banks may put into place stricter lending policies that could have a negative impact on your business’s access to cash. Not having cash is one of the biggest threats to your business, whether we are in a recession or not.

Review Your Accounts Receivables. Don’t be the source of cash for someone else. If you have any outstanding receivables, start proactively collecting (send statements, call contacts to have them get invoices paid, call accounts payable/bookkeeper, send emails, etc.) In addition, nail down your own credit policies and have a consistent accounts receivables collection procedure in place. The last thing your business should have during a recession is any late receivables. All this means is that your cash is in someone else’s bank account.

Review Your Accounts Receivables. Don’t be the source of cash for someone else. If you have any outstanding receivables, start proactively collecting (send statements, call contacts to have them get invoices paid, call accounts payable/bookkeeper, send emails, etc.) In addition, nail down your own credit policies and have a consistent accounts receivables collection procedure in place. The last thing your business should have during a recession is any late receivables. All this means is that your cash is in someone else’s bank account.- Manage Debt. If at all possible, pay down your debt. Most debt comes with fixed monthly payments (like a mortgage) that are due whether you have $1 million in revenue that month or a penny in revenue. Debt often requires collateral. If a recession hits and you miss payments; a lender will take over the asset that you up as collateral. There is a great scene in Goodfellas that sums up debt and the burden that it could be in down times.

- Understand Your Break-Even Point (BEP). What is your current monthly BEP on a cash basis? The equation for BEP is:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

If you need a deeper dive to understand calculating your BEP, this post explains it in detail “Break-Even Analysis 101: How to Calculate BEP and Apply It to Your Business”. Once you understand what your BEP and how each component of the equation impacts your BEP, you can analyze what-if scenarios to see the changes in your BEP (for example, paying off debt decreases your fixed cost which will lower your BEP). The greatest benefit of understanding your BEP is that you’ll know exactly what you need every month in order to stay in the black and you’ll understand what happens in different scenarios. This gives you the ability to plan accordingly.

And here’s the kicker – let’s say you do your work and prepare, but we avoid a recession. Was all this work for naught? Nope. Now you have cash in the bank, a reserve credit line available, no late invoices due from customers and sound A/R procedures, manageable debt and a full understanding of your BEP. Now, imagine having these resources available during stable or growing economic times…